Understanding the Built-in Gain and Loss Rules of Section 382—and Possible Significant Changes on the Horizon | Tax Executive

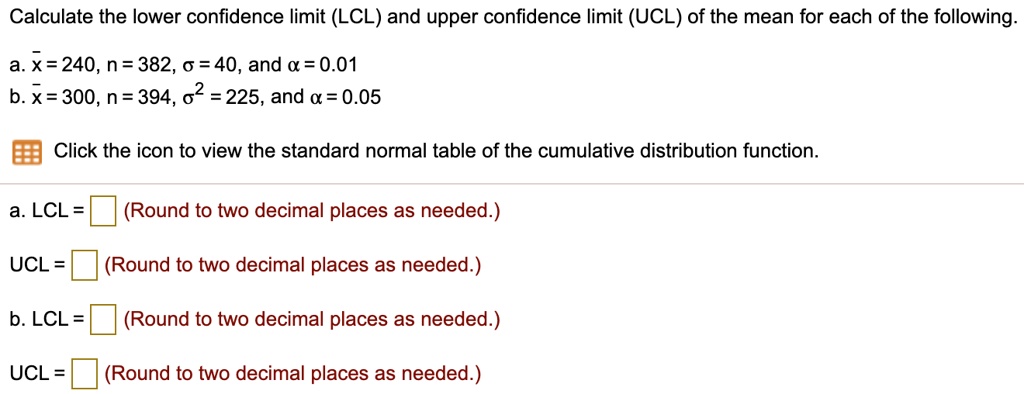

SOLVED: Calculate the lower confidence limit (LCL) and upper confidence limit (UCL) of the mean for each of the following a.X=240, n = 382, 6 = 40,and =0.01 X=300,n=394,02 = 225, and =

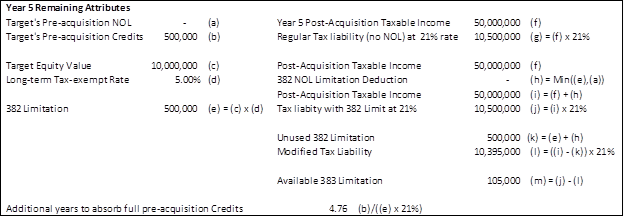

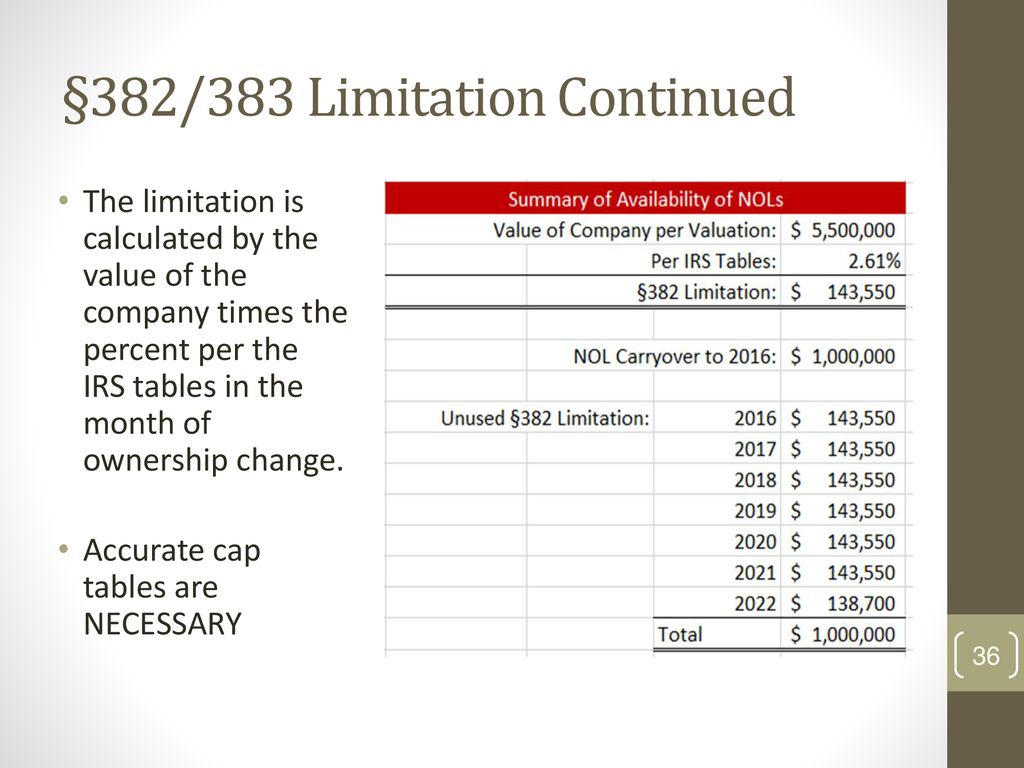

For the Record : Newsletter from Andersen : Q3 2019 Newsletter : Sweetening the Deal: The Value of Research Tax Credits in a Merger or Acquisition

:max_bytes(150000):strip_icc()/Netoperatingloss_4-3-v2_Final-ce7801af8cec4d8783f079c68ea7544d.png)